The I Don't Care Portfolio

The best investment portfolio is one that you don't have to look at.

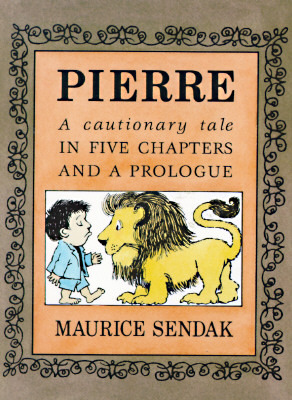

I don't want to care what is happening to the Yen carry trade. I don't want to have to hang on Powell's every word. My goal is to have a portfolio where no matter what unfolds I can say: "I don't care" kinda like the little boy from the Pierre story.

After you accrue assets it can be temping to spend a lot of time fretting over your investments and your asset allocation. The tricky thing about investing is that, unlike many other endeavors in life, more effort does not necessarily mean better results.

In fact, there's a sort of paradox where caring less about all the ups and downs will very likely make you a better investor.

There are three reasons I focus on building an I Don't Care portfolio:

- Not being stressed about my portfolio lets me make better investment decisions

- I want money to give me freedom, not chain me to market data feeds every day

- "You're not Stan Druckenmiller" (I tell myself this in the bathroom mirror every morning)

If you have a portfolio where you have to stay in top of the news, the market, or your portfolio more than every few months your money owns you - not the other way around.

A lot of people I know might be surprised to hear me say this.

I love investing. I follow the market. Pretty much every week I watch The Compound on YouTube while running at the gym, and I listen to Invest Like The Best, and Morningstar's The Long View while in transit or even when I'm eating.

I enjoy thinking about investment decisions, reading about markets, and watching stocks.

I also enjoy having the freedom to turn all of it off.

Sometimes I turn it off because I'm deep in work and I don't want to be distracted - even for days or weeks a time. Sometimes I'm focusing on my family. The point is - I like the flexibility to engage - or not.

That flexibility is what the I Don't Care portfolio gives you.

Equally important to time and attention freedom, the I Don't Care (IDC) portfolio is more robust and less fragile. If you need to keep watching the portfolio then you've introduced a source of risk that I don't want.

How to tell if you have an IDC portfolio

- You wouldn't lose sleep on the day your largest position lost 25% of its value

- You can go weeks without checking your portfolio or any stock prices

- In the market route-and-bounce of the week of August 5th you weren't worried

Rules for constructing an I Don't Care portfolio:

- Hold enough safe assets not to worry about major dislocations

- Hold enough equities you don't worry about inflation

- Diversify enough that you're not making existential bets

- Buy things with no plan to sell

- Focus on income instead of asset values

- Hold enough safe assets

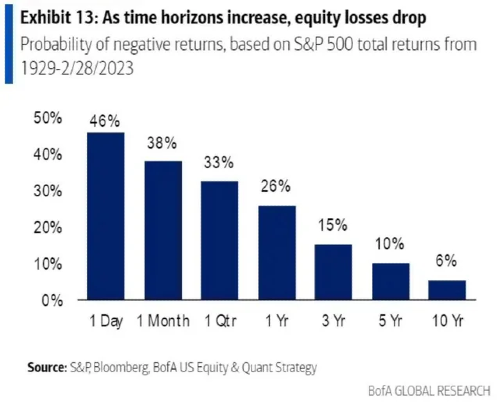

This was covered in Allocating Capital: Fixed Income - but basically the goal here is to have enough cash flow and cash reserve to weather any extended periods of equity losses. Selling during sharp drawdowns is how you really lose money.

Here you can see that it's almost a coin flip to be up or down over a day, but if you can make it 5 years on your safe asset base you only have a 1 in 10 chance of having to draw down a loss.

- Hold enough equities you don't worry about inflation

This is discussed in more detail in Financial Relativity - You need to own real assets to protect yourself from inflation and participate in the growth upside of technology and the real economy.

- Diversify enough

This is perhaps the most contentious rule in this plan.

Those steeped in the academic research and wealth management best practices live by broad diversification.

Those who wish to outperform and feel they have an edge will deride this approach as diworsification pointing out that fortunes are made through concentrated holdings.

In some cases the diversification is about dealing with concentrated positions (see Only a fool gets rich twice) - but in others it has to do with degrees of concentration. E.g. Should you own Emerging Markets stocks? Why not only buy US stocks (they've outperformed a lot) – or only the best 7 stocks in the market?

I think "Diversify Enough" means positioning the portfolio such that if a single company, sector, or country has very rough 10-20 year period, you'll be ok.

- Buy things with no plan to sell

I don't like selling and I'm not good at it.

First, because of my tax status as an American Citizen I'm obliged to give up as much as 40.8% of short term investment income (Short Term Rates of 37% stacked with Net Investment Income Tax of 3.8%).

"The strategy of Berkshire is to buy shares and hold them forever. That way, you get the full benefit of the compounding of the underlying business, while also minimizing taxes." - Warren Buffet

Unless you're blessed to only be subject to a tax regime like that of Singapore where capital gains taxes are not imposed at all - selling will incur tax costs. The tax costs will in turn incur mental costs - and potentially make you less likely to sell when you should.

Second, selling requires overcoming an endowment bias, discovered by economist Richard Thaler, explains why it's so easy to become attached to assets we already own.

"People often demand much more to give up an object than they would be willing to pay to acquire it." - R. Thaler

Finally, it's just a whole other action I have to make time and mental space to plan to take.

The point here is not that I never sell - you have to sell investments sometimes. If you end up with a single, very large concentrated position because an investment has worked really really well - then you need to figure out how to deal with the effort, bias, and taxes and make it work for your portfolio. I don't want to be in a position where I'm constantly doing that.

I'll only get into an investment if I can see holding it for a long period of time and don't have a particular plan to sell it. This prevents me from trying to predict the future, and forces me to set it and forget it.

- Focus on income instead of asset value

Day to day the value of a portfolio is a useless vanity metric.

The portfolio value is based upon what someone else will pay for those assets - and that willingness to pay is constantly shifting and subject to very sharp revisions if new events or data come to light.

Unless and until you're prepared to sell the value of the portfolio is not all that useful - and may actually be harmful. During bear markets you might get scared or frustrated and sell. During bull markets you might get overconfident and excessively increase your spending or risk profile.

Instead you can focus on the income that is coming off of your portfolio which is the old fashioned way to think about a set of assets. The point here is to think about the yield of the portfolio - instead of the value ("I have a portfolio that generates 100k/yr, and over 10 years that will rise").

I'll be careful to caution that reaching for yield - i.e. buying the highest yielding stocks, funds, bonds, etc without careful analysis is a bad idea since it pushes you to buy riskier assets. There is a lot more to say about constructing investment streams of income, perhaps another time if readers are interested.

When and how to care

Of course this whole post is a bit cheeky since the moral of Maurice Sendak's "Pierre: A Cautionary Tale in Five Chapters and a Prologue" is that indifference and apathy can have serious consequences.

I believe that your investment choices matter a great deal - but the effort and decision making needs to happen up front before events unfold. If you're trying to reactively manage your portfolio as news and price fluctuations roil your balance sheet you've already lost the game.

The time to care is when you're setting up your asset allocation or making large investment decisions - not when news breaks.

Feedback, thoughts, and book recommendations welcome: n@noahpepper.com

PS - The header image was generated with a Stable Diffusion XL variant where I had a prompt involving a kid, a lion, and Maurice Sendak – here is one additional gem that got produced.