Boring Shovels

I'm generally skeptical that I have an edge in public markets. I know a lot of professional investors and they're exceptionally smart and have way more data, time, and other resources than I do.

One of the most durable advantages I can have is slightly different preferences for my investments.

Think about it this way: The demand to find the next Nvidia is almost infinite. Every professional public market investor, family office allocator, and amateur investor - they all want to own whatever stock has a good shot at going up 1000% over the next few years.

I also like to play this game - but I know that it's a competitive and crowded game.

I think the more boring "picks and shovels" play in the AI boom might be the renewable energy developers and operators. They're never going to give you Nvidia like returns - but they trade cheaply, produce tax-advantaged income streams, and are setup for 12%+ growth per year with multiple positive catalysts.

Plenty of people are looking for these trades - but they're incrementally less exciting and therefore less crowded.

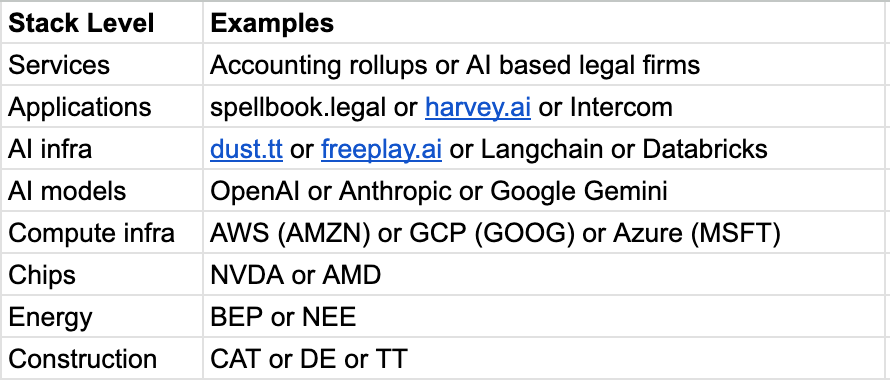

AI Boom Stack

Everyone knows that AI is going to change the world - but it's quite difficult to know exactly who will benefit - both in terms of which part of the stack - and which players in each stack layer.

Each of these parts of the stack has different risks.

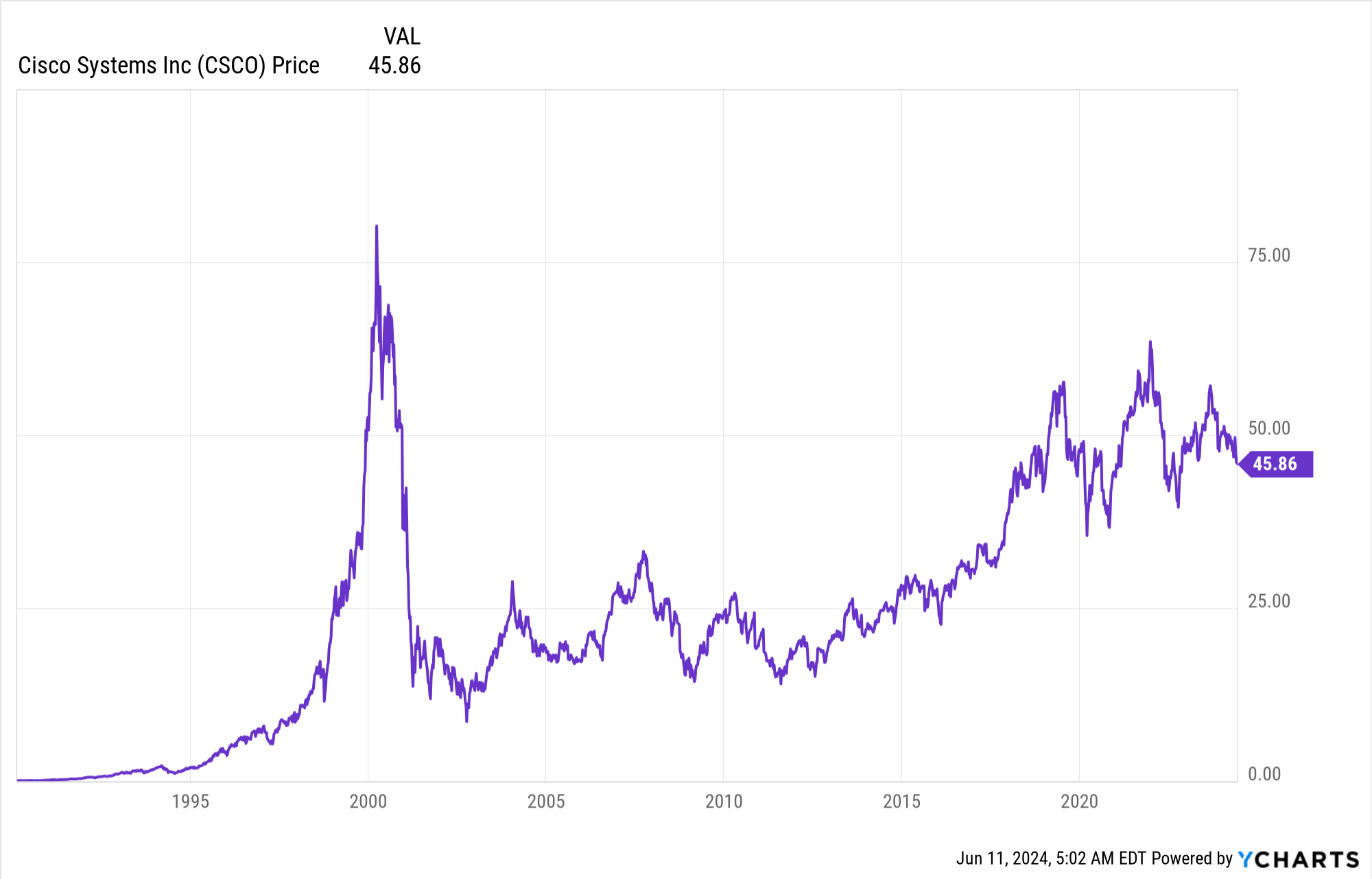

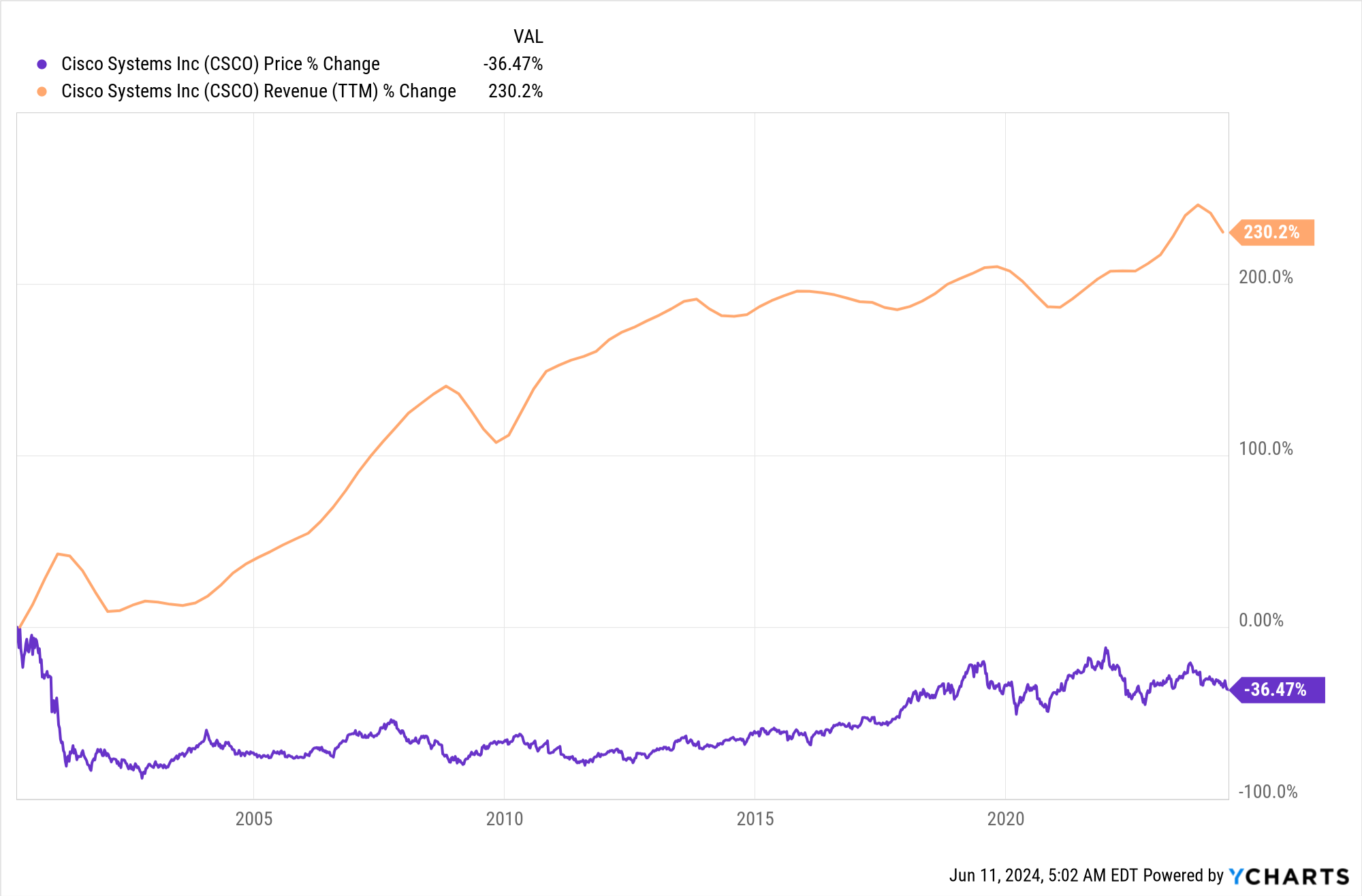

Chip producers have performed exceptionally well recently - but face a potential overbuild problem where, if there's a pullback, hyperscalers may slow or cancel chip orders. This is what happened in the dot-com bubble with fiber optic and network equipment over-provisioning and a look at the CSCO chart tells the story.

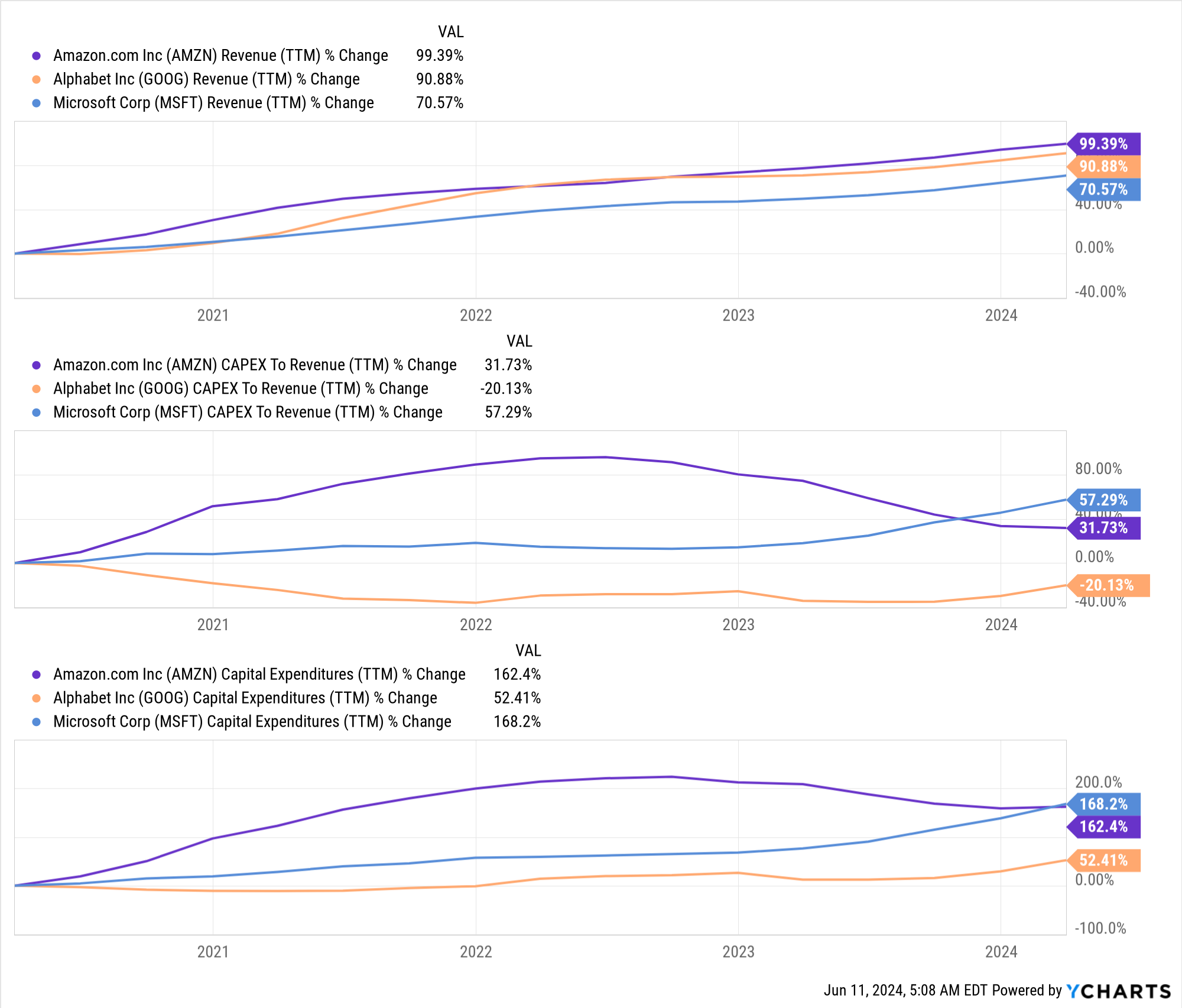

Compute infrastructure (e.g. Amazon/AWS or Google/GCP) are good classic "pick and shovel" plays - but also face "overbuild" risk like chips. Further, because of the incredible demand for chips, power, and data center construction they're facing enormous capital requirements.

Services automation has a chance to capture the largest portion of the value (being closest to the customer with the greatest pricing power) but will be tricky to execute well because it will require a new way of running a company that hybridises technology and services operations.

The Application and AI infra layers will have the fiercest competition as they're asset light businesses where tens of billions of VC dollars will flow looking for SaaS margins.

This post is about the Energy layer.

The Energy Layer

What do AI data center builds, decarbonisation, and energy independence all have in common? They’re generating massive demand for clean electricity from a few key suppliers.

In the last year some of my biggest single stock portfolio additions have been in a set of companies that have a chance to benefit from both AI and climate change.

I continue to be confused by the discounts these companies trade at - and either there's an opportunity or I'm missing something important. Good investments where you're non-consensus and right involve an uncomfortable possibility that you're just non-consensus and wrong.

There is a massive increase in the demand for electricity due to both new energy loads (AI data center expansion) and shifting of energy loads from oil/gas to electricity (temperature control, mobility).

Further propelling a lot of this demand is that data center builders/customers need both electricity for compute - and cooling for that compute. These buyers are also companies with some of the most aggressive renewable energy targets in the world - and the deepest pockets.

This quote from Brookfield (BEP) last year sums up the point nicely:

As an example, we expect annual demand from large technology companies to accelerate meaningfully, increasing by more than 3x by the mid- to latter part of this decade on the back of growth in expected generative AI computing demand. These technology companies are already the largest corporate procurers of green power globally. So to put this growth into context, we could see the energy load from just one of these large global technology companies, with a 100% renewable power target equal the current load demand of the entirety of the United Kingdom. - Brookfield CEO, Aug 4 2023

There are just a few firms globally that can develop these really big projects and serve these large customers - the CEO continues:

We have long-standing global relationships with firms facing these needs and are currently engaged with a number of them around strategic partnerships where we are well positioned to be a trusted partner given our capability and credibility to provide large-scale clean energy solutions on a global basis.

Generally outperformance comes from companies that are:

- A market leader

- In a large and expanding TAM benefiting from a secular trend

- With multiple ways to win

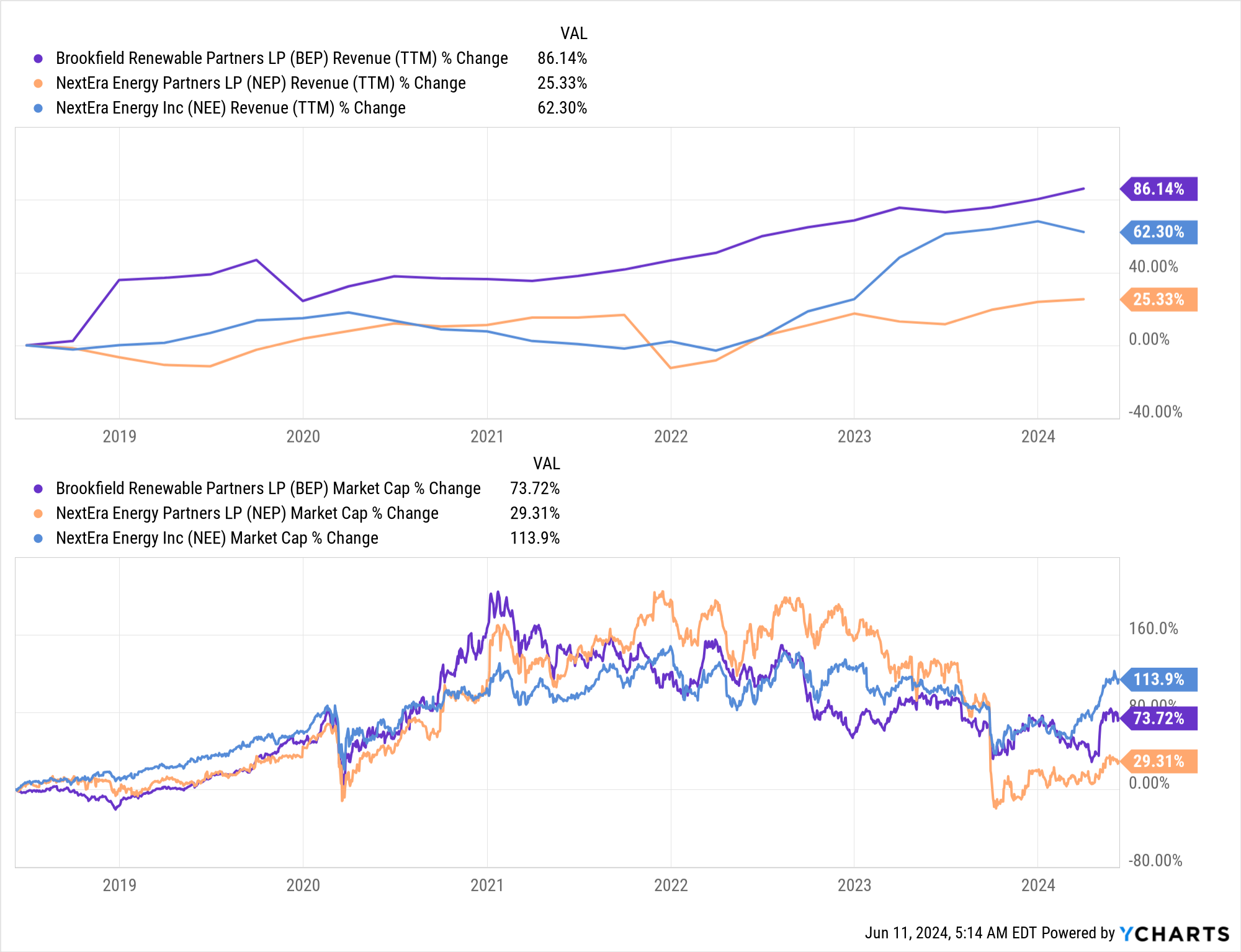

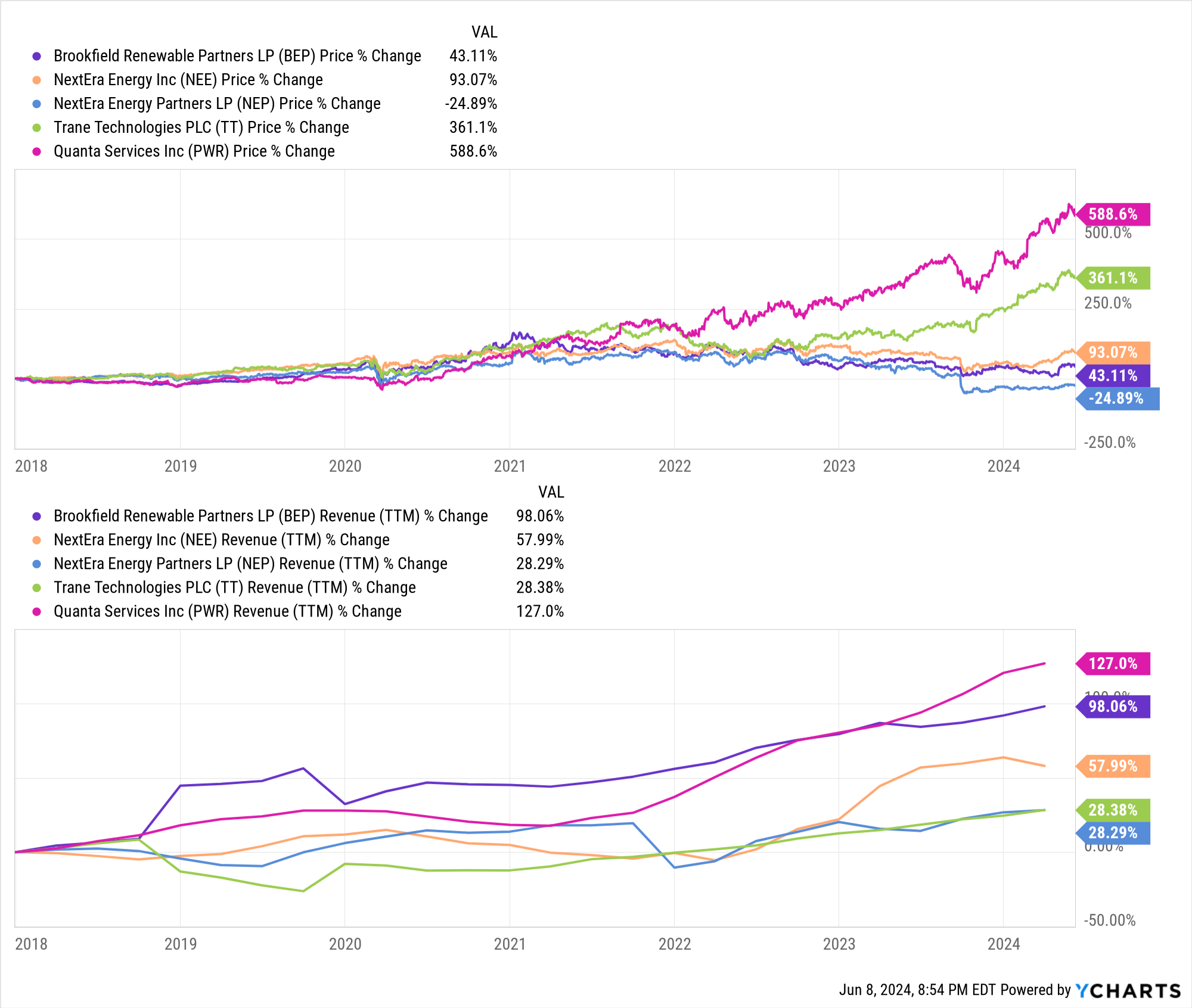

Brookfield and NextEra are two of the largest renewable developers globally. They're market leaders and they're growing rather quickly - especially when you consider that these businesses are large scale infrastructure developers that are, in the case of NEE, also operating regulated utilities.

BEP is the subsidiary of the Brookfield private equity group focused on developing and operating renewable power systems. NEE is the largest utility in the US - owner of FPL (Florida Power and Light) and an at-scale developer of national clean energy systems. NEP is a NEE subsidiary that is run as a "yieldco" - basically an entity to buy, operate, and distribute cash flows from NEE development projects.

It's pretty clear that demand for renewable energy sources is a large TAM that is expanding rapidly. The market leaders in this space likely face a significant advantage to other players due to their scale which impacts their cost of capital, ability to bid for and execute the largest contracts, and their ability to manage a pipeline of development opportunities.

In order to be a credible partner of scale, one, you need the capital and the amount of capital to support these types of partnerships is very limited to a small number of participants in the marketplace today. So we would certainly see that as a major limiting factor and one that differentiates us. But the other important things that we would highlight is you need the operating capabilities. This is bringing on multiple projects across multiple geographies concurrently. And therefore, you need that best-in-class development and construction capability. And then the last point is, even if you are large and have the capital and have the capabilities, you actually need the assets, you need the pipeline. And this is where our approach of acquiring pipeline over the last 2 or 4 or 5 years is really coming to fruition because we have the projects and the assets to meet this growing demand already. This is a very real opportunity today and really lends itself to those that have that pipeline already, not those who are going to start developing it today in order to deliver it several years from now. - BEP CEO May 3 2024

This theme around scale and serving the hyperscalers is consistent across both NextEra and Brookfield:

We do business with all the – what I would call the top 5 hyperscalers in this country, also doing business increasingly with some of the developers of data centers as well. And we've owned data centers. And so we understand how they work, how they operate, what the CapEx and OpEx is, and how it's driven by energy and power and what the right locations are for them. We develop tools to address them. And so what do we see? We see about a 15% CAGR through the end of the decade for data center demand. I think data center developers are really focused more than anything on 3 things. They want low-cost energy. They want to be able to say that they've accomplished additionality from a decarbonization standpoint, which requires a new facility to be built, not an existing facility. And third piece is it's got to be in the right location and it's got to have speed to market. - NEE April 2024

Comparing the revenue growth vs price growth since 2018 across a number of "renewable" and "power" adjacent businesses it's interesting to see how much Brookfield and NextEra have grown revenue relative to price.

Income and Return

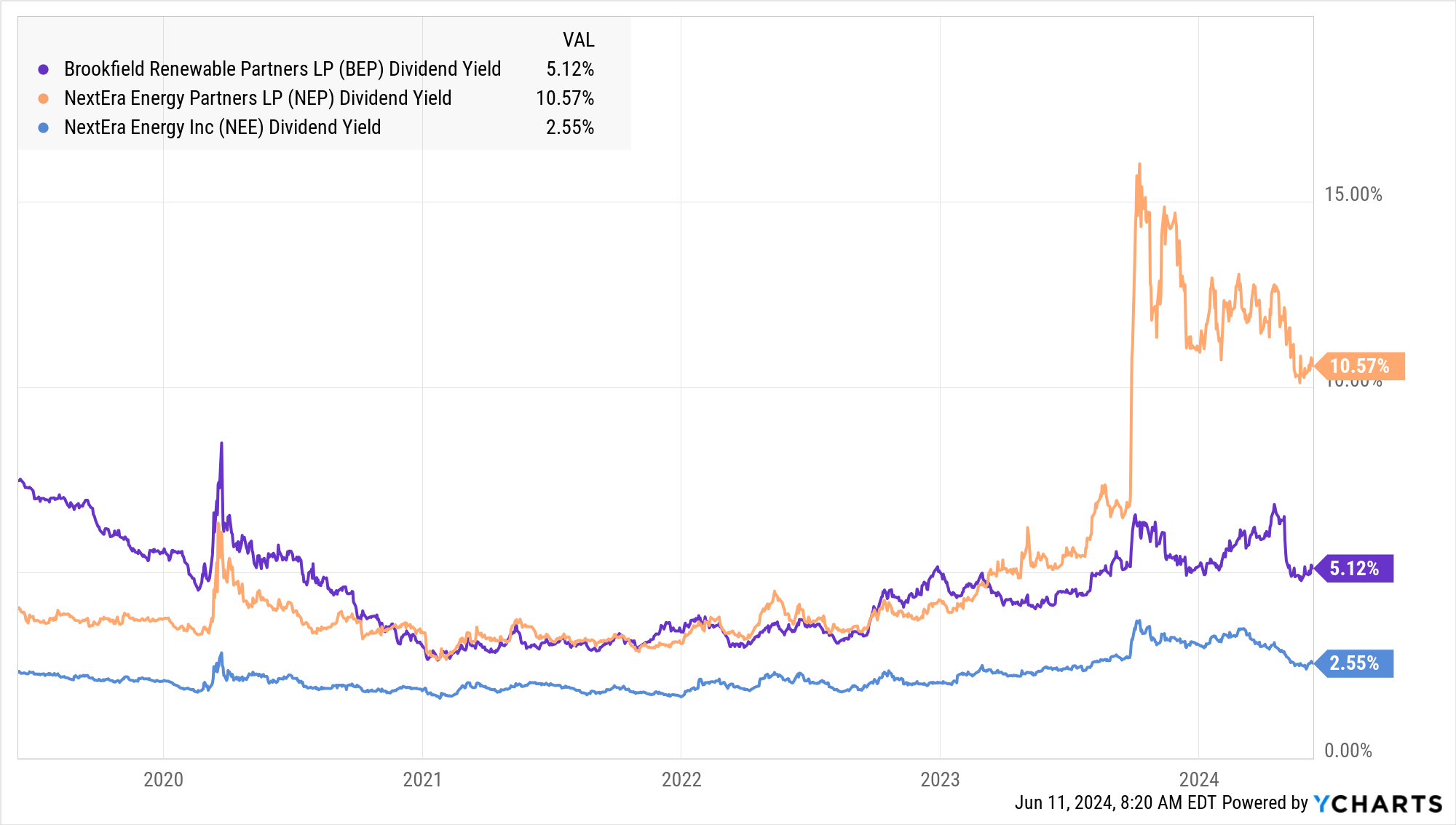

I'm a US taxpayer so I have to consider the tax treatment of my investments carefully. BEP, NEE, and NEP all provide favorable treatment to the distributions they make.

NEP dividends are often accounted for as a return of capital - thus reducing your cost basis but not creating any immediate tax liability.

NEE pays dividends that are qualified - meaning they are subject to a lower tax rate than taxable bonds or REITS - other common sources of investment income.

BEP dividends in recent years have been treated as long term capital gains.

As someone who is looking to generate both appreciation and income from my portfolio these stocks provide pretty high yield, with moderate risk, and favorable tax treatment. The combination of these factors is a compelling part of the story for me.

The NEP dividend in particular is high enough that it should raise some alarm bells for any experienced investors. So... time to ask about the problems and what could go wrong.

Inversion Questions

What could go wrong here?

A) Renewable electricity demand could soften - due to overall economic slowdown, political backlash that favors traditional fuels, or some combination thereof.

I think this is unlikely due to the extremely long development lead times, price favorability of renewables once developed, and strong social pressure from the public for major corporations to get carbon neutral.

B) Other players could fill the renewable demand, maybe with new technologies

This would be a societally great situation to have either more competitors building in this space and/or disruptive new technology - but this seems like a slower moving innovation trajectory than some things we get used to in tech.

Further, the capital requirements are massive so having the largest utility in the US (NEE) or a huge PE firm (Brookfield) backing these things seems to all but rule out upstart competitors

C) Costs to develop could go up - including borrowing costs

This is probably the most realistic risk - these stock took a beating when interest rates rose rapidly. It does seems like we're towards the end of the hiking cycle and so while this risk does exist, the inverse is also true and if interest rates drop these these names are positioned to move higher, potentially massively.

What Excites the Bears?

There are plenty of people who are bearish on these companies, why?

1) Interest rates, borrowing costs, and capital requirements.

All of these renewable development and operating companies have two ways in which higher interest rates hurt them.

First, they compete for income oriented investor attention with fixed income. Higher interest rates means the amount of yield investors hunting for income will demand is higher.

Second, their developments are capital intensive, and they use leverage to finance their projects and the higher the borrowing cost they face the more this eats into the returns the companies can produce.

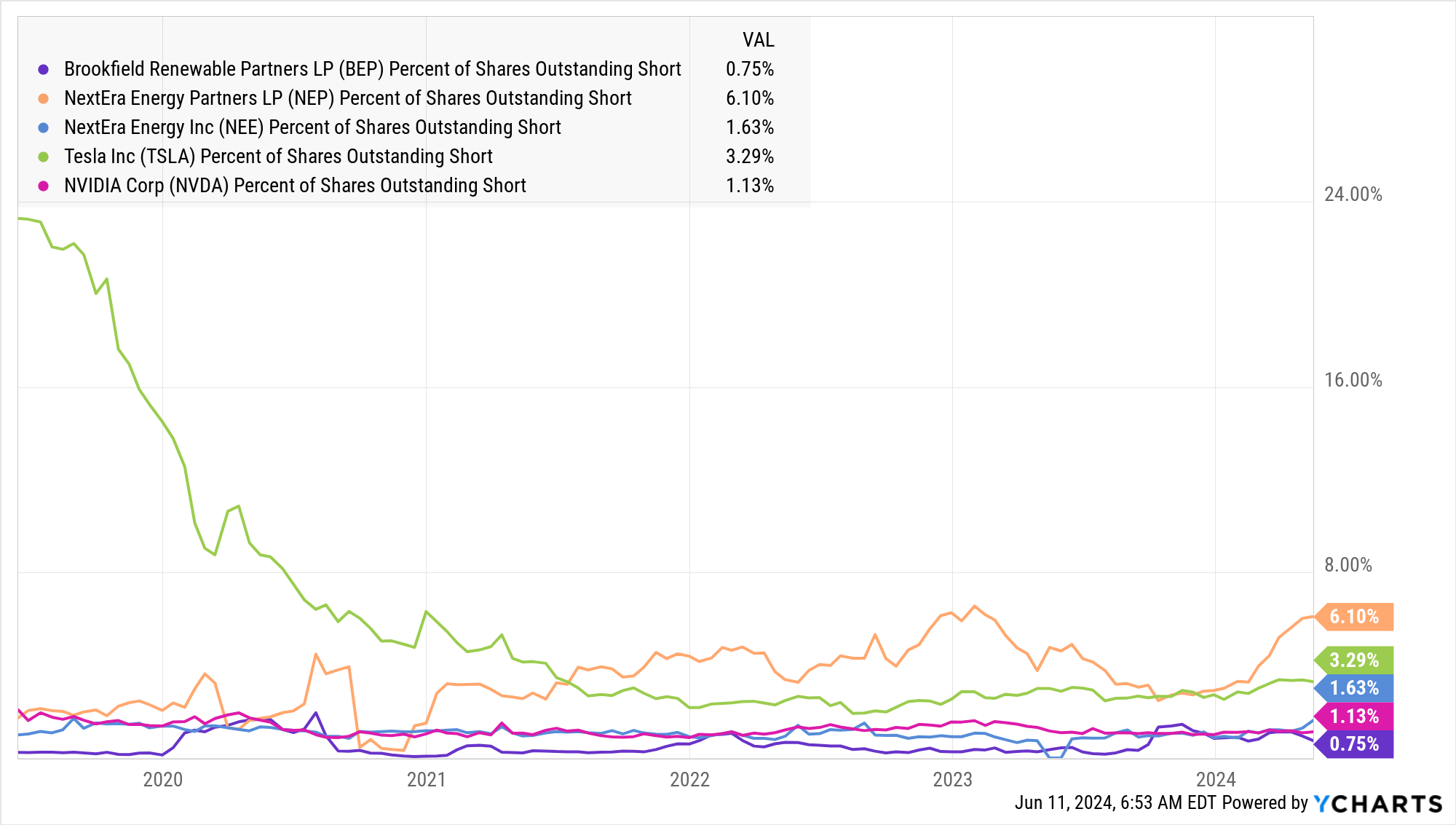

NEP is especially vulnerable here - and you can see that in the short interest (higher than Tesla right now!) - because they have debt maturing over the next few years that will increase financing costs and put pressure on the company's ability to support the dividend.

2) It's boring

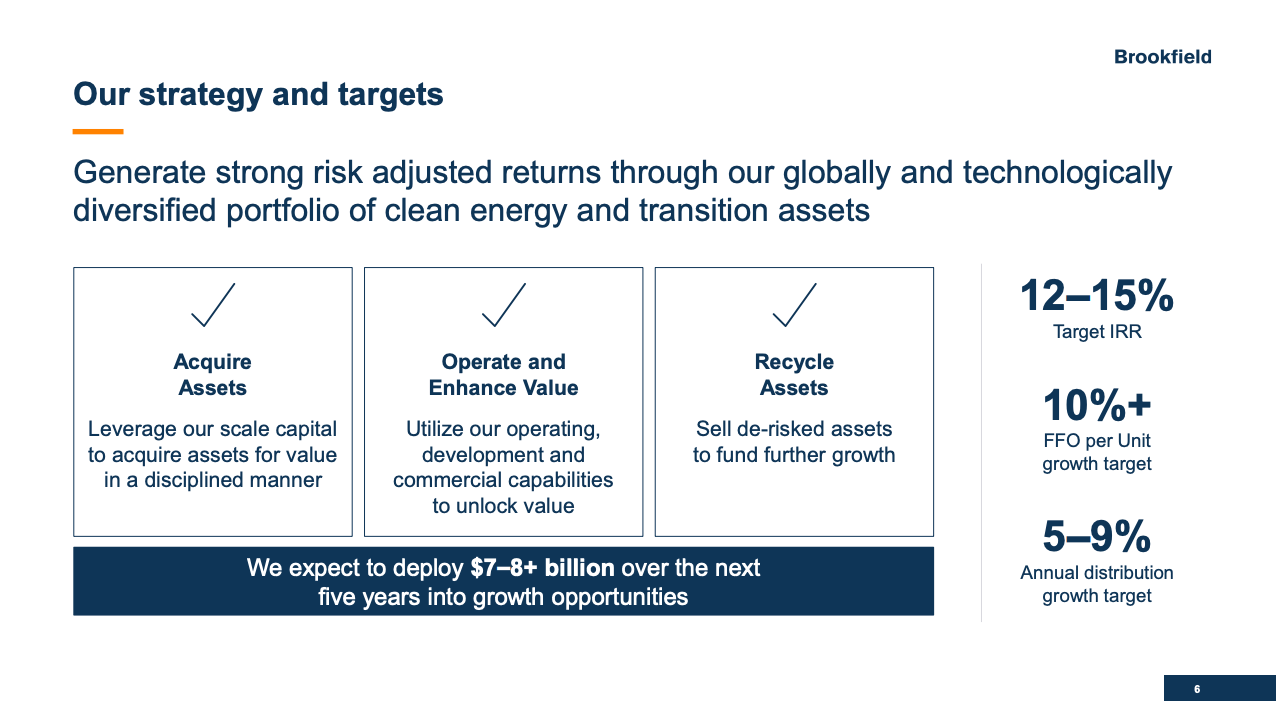

These companies are targeting low-to-mid teens growth. Take BEP as an example which currently yields 5% and aims to grow that yield by 5-9% - just from a distribution perspective this is a 10%-14% return without needing any multiple expansion.

When you consider that on average the market has produce maybe 11% - and at today's valuations a reasonable forward estimate might be 8.5% - a clear view to 10%-15% sounds pretty good to me!

The downside for a lot of investors is that this is... well... boring.

Note: Nothing here is investment advice. This is written for my entertainment and clarity of personal thought. My individual public stock portfolio is under 10% of my asset allocation and therefore no individual position I hold is particularly material for me.